Contents

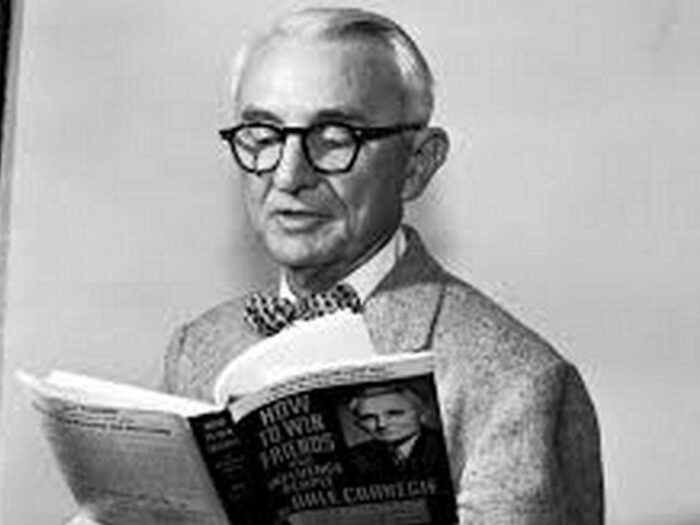

This rule is in place to stop companies from buying all the stock available for sale to juice the stock price. We can see on the chart that, at one point, the stock price fell from around $125 to $112 a share. Using average volume as one of several data points for investing decisions was popularized, in part, by William O’Neil’s How To Make Money In Stocks. The Motley Fool has no position in any of the stocks mentioned. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors.

- It’s an indication of the interest that investors have in that particular security or product at its current price.

- In fact, volume spiked to more than 70 million shares on that day.

- The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in.

- Previously, she was a television news producer for eight years.

- 84% of retail investor accounts lose money when trading CFDs with this provider.

- When the stock price is rising, you want increasing volume to signal that it will keep going.

The trading volume data provides important hints to savvy traders who don’t want to trade against the market’s supply or demand for a security. Several major drivers of the increase in trading volume statistics in markets, especially in the US, include high-frequency traders and index funds. Such passive investors utilize high-frequency algorithmic trading, which is a huge contributor to overall trading volumes in stock markets. Throughout the trading day, investors buy and sell stocks, and the transactions that occur between them lead to the total volume of that stock for that time period . Therefore, the data that’s collected and reported during the day are estimates, with the final trading volumes for that period reported the next day. Besides helping spot a trend, trading volume can also help guide an investor take profit and sell a security just in time.

A higher trade volume is representative of better order execution and higher liquidity. Days to cover measures the expected number of days needed to close out a company’s shares outstanding that have been shorted. A stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed-upon price and date.

Short-term Access

Investors look at trading volume to help evaluate a stock’s activity and liquidity, which is the ease with which transactions can be completed. For example, high trade volumes suggest high liquidity and easy order processing because it’s easier to match buyers and sellers when there are more of them. Imagine that stock XY entered a consolidation phase at $110 after a strong uptrend and market participants shift their focus on the company’s fundamentals.

That’s because traders are responding to the news by either buying or selling the company’s shares. The above content provided and paid for by Public and is for general informational purposes only. It is not intended to constitute investment advice or any other kind of professional advice and should not be relied upon as such. Before taking action based on any such information, we encourage you to consult with the appropriate professionals. We do not endorse any third parties referenced within the article. Market and economic views are subject to change without notice and may be untimely when presented here.

Volume levels can also help traders decide on specified times for a transaction. Traders follow the average daily trading volume of a security over short-term and longer-term periods when making decisions on trade timing. Traders can also use several technical analysis indicators that incorporate volume.

The Indian capital markets regulator has sought details of all ratings of local loans and securities of Adani group companies from credit rating firms. To begin the legend removal process, an investor should contact the company that issued the securities, or the transfer agent for the securities, to ask about the procedures for removing a legend. Removing the legend can be a complicated process requiring you to work with an attorney who specializes in securities law. If you are an affiliate, you must file a notice with the SEC on Form 144 if the sale involves more than 5,000 shares or the aggregate dollar amount is greater than $50,000 in any three-month period. The My Trading Skills Community is a social network, charting package and information hub for traders.

Trading Volume

Its broker-dealer subsidiary, Charles Schwab & Co., Inc. , offers investment services and products, including Schwab brokerage accounts. Its banking subsidiary, Charles Schwab Bank, SSB , provides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. Average daily trading volume is the average number of shares traded each day in a given stock over a certain period. As you can see in the chart below, there was a massive volume spike on June 24, the day the “Brexit” vote sent shockwaves through the market.

By examining bar affiliates, avoid these two big mistakess, analysts can use volume as a way to confirm a price movement. If volume increases when the price moves up or down, it is considered a price movement with strength. Volume is one of the most important measures of the strength of a security for traders and technical analysts. From an auction perspective, when buyers and sellers become particularly active at a certain price, it means there is a high volume. For the price of a security to keep rising, an increasing number of buyers are needed, which would increase volume.

How Does Volume Affect Stocks?

It is because 100 shares of Alpha were traded, 50 shares of Beta were traded, and 200 shares of Gamma were traded. The first trader, X, purchases 100 shares of stock Alpha and sells 50 shares of stock Beta. The second trader, Y, buys 200 shares and sells 100 shares of the same stock, Gamma, to X. If traders want to confirm a reversal on a level of support–or floor–they look for high buying volume.

Easily research, trade and manage your investments online all conveniently on Chase.com and on the Chase Mobile app®. Morgan online investingis the easy, smart and low-cost way to invest online. JPMorgan Chase & Co., its affiliates, and employees do not provide tax, legal or accounting advice. Information presented on these webpages is not intended to provide, and should not be relied on for tax, legal and accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transaction. I’d like to view FOREX.com’s products and services that are most suitable to meet my trading needs.

This can refer to shares of an individual stock, the number of options contracts traded, or the total number of shares exchanged within an index or an entire stock market. Daily volume is the most commonly used time period, but volumes over longer or shorter periods of time can be useful as well. Each market exchange tracks its trading volume and provides volume data either for free or for a subscription fee. The volume of trade numbers are reported as often as once an hour throughout the current trading day. A trade volume reported at the end of the day is also an estimate.

It’s important to note that when counting https://business-oppurtunities.com/, each buy/sell transaction is counted only once. In other words, if one investor sells 1,000 shares and another investor buys those 1,000 shares, it will count as volume of 1,000 shares, not 2,000. This may sound obvious, but it’s a rather common misconception. Similarly, when a security is traded less actively, its trade volume is said to be low. A Bollinger Band® is a momentum indicator used in technical analysis that depicts two standard deviations above and below a simple moving average.

Still looking for a broker you can trust?

“Purchases of Certain Equity Securities by the Issuer and Others.” Accessed Oct. 28, 2021. Morningstar calculates the average based on the trailing twelve months—other websites may use different lengths of time. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

Resources Learn Browse our latest articles and investing resources. Alternatives Buy fractional shares of fine art, collectibles, and more. Get the latest crypto news, updates, and reports by subscribing to our free newsletter.

The most common periods are one month, one quarter, or one year. Average daily trading volume is generally compared to either the daily volume or another average calculated over a different time frame, to find how much volume is changing. The trading volume of a stock reveals to investors how many shares are being transacted. Investors can combine this data with other information in their investigation. Volume doesn’t always indicate whether reversals are about to occur, but it can offer traders some insight into what is likely to happen. The most common timeframe to use when talking about volume in stocks is the daily volume.